Updated 7 October 2019

The City Council Office of Financial Analysis (COFA) has made its first-ever public analysis of Chicago's annual Comprehensive Annual Financial Report.

COFA's analysis of the finance department's report essentially preps aldermen for the coming budget proposal by Mayor Lori Lightfoot.

The Chicago Dept. of Finance's 2018 financial report was issued on June 28, 2019. The finance department said that its report aims to "provide complete and accurate financial information"—and it obeys a state law that says the city must publish a financial statement for the prior fiscal year "in conformity with generally accepted accounting principles . . . and audited by a licensed public accountant."

Key findings

COFA's 26-page analysis—titled "Summary and Analysis of the City of Chicago’s 2018 Comprehensive Annual Financial Report"—includes these findings:

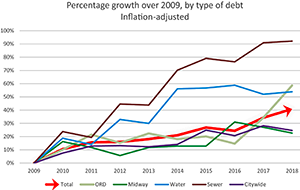

- The city has debt that grew about 41 percent from 2008 to 2018, and it ended 2018 with total long-term debt of $26.8 billion. Less than one percent is composed of tax-increment financing (TIF) debt.

- During those 10 years, the city's debt grew faster than revenue, while revenue grew "faster than most economic indicators." The city's debt grew even as capital spending fell sharply.

- The growth in the city's long-term debt during 2018 was almost entirely due to O’Hare airport debt.

- Debt grew while capital spending dropped, partly because the city’s four "enterprise" sources of revenue (O’Hare, Midway, water, and sewer) began contributing to pension funds—cutting the amount of capital funding in their respective areas.

- Although the city contributed a record $1.16 billion to its pension funds in 2018, the funds' unfunded liability grew to $29 billion—due to negative investment returns and the city contributing less than what's "actuarially determined."

- In 2018, the city’s General Fund (Corporate Fund plus Garbage Collection Fund) spent $115 million more than budgeted on lawsuit settlements and judgments. Of that, $84 million (73 percent) was incurred by the police department.

- Twenty-nine of 31 departments financed by the Corporate Fund spent less (significantly less, for many) than budgeted.

- A minority of Chicago's high-income earners "are growing in prosperity, while incomes remain stagnant for half or more of households."

- COFA questioned the finance department's calculation of city debt per capita. COFA said that the department's choice of population statistics leads to "some peculiar . . . results in the per capita debt tables."

Why haven't we seen this before?

For most of its six-year history, COFA has had only one employee: chief administrative officer Ben Winick. That's in spite of the fact that, over the years, COFA has been budgeted for several analyst positions. They've mostly sat vacant.

Though it has a $300,000 budget, COFA has lacked any kind of presence on the city's Web site, and it hasn't generally published its analyses. (Winick did, though, give Inside Chicago Government his 2016 revenue estimate for the city's nascent transit TIF district.) COFA finally got its own Web real estate in October 2019.

COFA's lack of visible output is partly due to restraints imposed by city ordinance: Analysis requests by aldermen must be approved by the council's budget committee chair, formerly Ald. Carrie Austin (34th)—who, after Lightfoot's 2019 election, was replaced by Ald. Pat Dowell (3rd).

COFA chief Winick quit unexpectedly last May. The month prior, Winick had hired analyst Jonathan Silverstein, who's now COFA's sole employee.

From the time Dowell became budget chair, Silverstein said, she made clear her intent for COFA to be more active and transparent.

More, publicly-presented analyses are reportedly in the works.

Document: "Summary and Analysis of the City of Chicago’s 2018 Comprehensive Annual Financial Report"