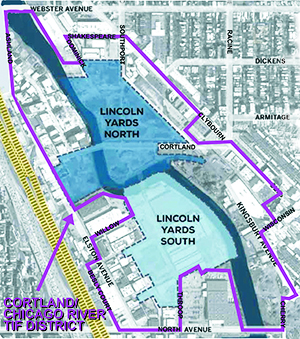

The city of Chicago has proposed a tax-increment financing (TIF) district that will encircle all of a planned residential and commercial development along the Chicago River's North Branch.

The development, called Lincoln Yards, will take up about 53 acres north and south of Cortland Ave. According to developer Sterling Bay, the complex will house 4,000 to 5,000 residential units, and will include a "minimum 50 percent" level of commercial use.

Sterling Bay plans that its two-part complex—Lincoln Yards North and Lincoln Yards South—will cover two sprawling, but now vacant, tracts of land: the former site of Finkl Steel on the river's east side, and the city's former vehicle maintenance facility on the river's west side.

The city calls its proposed TIF district the Cortland/Chicago River Redevelopment Project Area.

Sources: City of Chicago, Sterling Bay. Rendering by Tim Ryan.

A TIF district is a special zone in which some of the property taxes paid by landowners are diverted away from schools, parks, and county services. The taxes are instead amassed in an off-budget account, and may be used within the zone to fund building development—by reimbursing private developers for construction debt, and/or paying for new streets, water lines, sewers, and lighting.

In Chicago, although the city council must approve a new TIF district, its placement and implementation are controlled by the mayor.

Critics say that TIF districts siphon away property-tax dollars for far too long: 23 years minimum, as allowed by state law. During that time, a district can divert many millions of dollars—which the city's other taxpayers must make up for by paying more.

An estimate of the property tax dollars that the Cortland/Chicago River TIF district would divert annually hasn't been disclosed by the city. But in an August interview with real estate magazine The Real Deal, Second Ward Ald. Brian Hopkins said, "Sterling Bay is predicting Lincoln Yards will bring $80 million a year in net new property tax revenue."

The proposed TIF district will also contain many parcels on all sides of Lincoln Yards, most of which appear to be commercial or industrial properties.

If the assessed values of these properties increase due to improving real estate conditions, the resulting boost in property taxes would likewise be captured by the Cortland/Chicago River TIF district's fund.

Four sets of nearby property, however, would escape the proposed TIF district: the Home Depot at 1232 W. North Ave.; the two-building retail center at 1765 N. Elston Ave.; the Clybourn Commons strip mall at 2000 N. Clybourn Ave.; and the recently completed C.H. Robinson headquarters at 1515 W Webster Ave. (developed by Sterling Bay). The TIF district's boundary loops around, and therefore avoids, these properties.

But three of those properties reside inside an existing TIF zone, called the North Branch South TIF district. In fact, the entire south half of the proposed Cortland/Chicago River TIF district lies within the existing North Branch South district.

The latter district is due to expire on Feb. 5, 2021. But, earlier this year, the city quietly changed a sentence in the district's lengthy redevelopment plan—a change that implies that the city will extend the life of this district beyond its initial 23-year span.*

Although the Cortland/Chicago River TIF district, and the footprint of Lincoln Yards, reside entirely within the city's Second Ward, its east side abuts the 43rd Ward—where Ald. Michele Smith has questioned the city's lack of detail about how and why TIF will benefit the development of Lincoln Yards.

"Without revealing planned uses of TIF funds," Smith wrote to constituents on Nov. 5, "the public cannot judge whether this is a proper use of taxpayer dollars."

The city's planning department will hold its first public meeting on the proposed Cortland/Chicago River TIF district on Wednesday, Nov. 14, 6:00 p.m., at 1001 N. Crosby St.

*In the redevelopment plan for the North Branch South TIF district, the city removed the words shown here in brackets: "Public improvements may be necessary in furtherance of this plan throughout the [23-year] period that the plan is in effect."