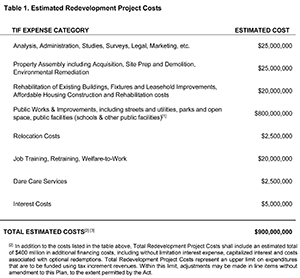

Cost detail for the Cortland/Chicago River TIF district, from p. 24

of the city's redevelopment plan. Source: city of Chicago.

The city expects to pay out at least $1.3 billion in collected property taxes from a special taxing district, according to a newly released report.

The city's Dept. of Planning and Development on Dec. 12, 2018 released on its Web site a document titled "Cortland and Chicago River Tax Increment Financing Redevelopment Area Project and Plan." The document lays out the city's rationale for the tax-increment financing (TIF) district that would encircle the proposed Lincoln Yards development.

The planning department has previously said that property taxes accumulated by the district would fund up to $800 million in infrastructure that would help real-estate development in the district.

But now, according to the document, the district's expenses "shall include an estimated total of $400 million in additional financing costs," plus $100 million for property acquisition, affordable housing, job training, child day care, and relocation costs—for a total of $1.3 billion.